unified estate tax credit 2021

Free means free and IRS e-file is included. Any tax due is determined after applying a credit based on an applicable exclusion amount.

This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples.

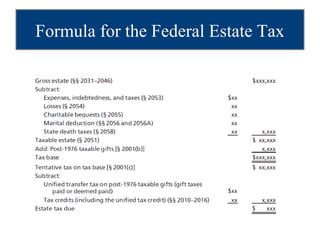

. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. For 2021 the estate and gift tax exemption stands at 117 million per person. The tax is then reduced by the available unified credit.

Effective January 1 2018. The amount of the estate tax exemption for 2022. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

2021-03-15 For 2009 tax. For 2021 that lifetime exemption amount is 117 million. Get information on how the estate tax may apply to your taxable estate at your death.

Effective July 1 2018. Right now the unified credit exemption is 11 million for single individuals and about 23 million for married couples. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020.

For a married couple that comes to a combined exemption of 2412 million. The office will be open from 8 am. Estate Tax Exemption Basic Exclusion Amount 11700000.

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied. Gift Tax Annual Exclusion. Highest tax rate for gifts or estates over the exemption amount Gift and estate exemption 2017 and prior years Gift and estate exemption 2022 expires in 2025 40.

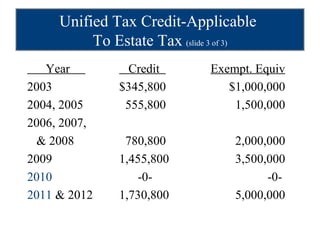

For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021. The clear trend in the past 20 years has been to increase the exemption and decrease the tax rate.

Mar 16 2021 The IRS announced in October 2020 that the estate tax exemption will increase to 117 million for tax year 2021. Generation-Skipping Transfer GST Tax Exemption. The 2021 federal tax law applies the estate tax to any amount above 117 million.

The previous limit for 2020 was 1158 million. New CLE Category of Credit. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

Max refund is guaranteed and 100 accurate. After the unified credit limit is reached the donor pays up to 40 percent on that exceeding the unified credit. Smoke Carbon Monoxide Detectors.

In addition this department collects annual sewer fees. Fire Prevention Home Safety. Ad All Major Tax Situations Are Supported for Free.

With the passage of the Tax Cuts and Jobs Act. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied. This is called the unified credit.

Taxable Income Threshold at which Highest Rate Applies for TrustsEstates. Is added to this number and the tax is computed. Information can be viewed free of charge.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. This tax applies to the combined amount of money you give away during your lifetime and at your death. The tax collectors office will have extended hours on Wednesday Nov.

If the value of the estate is more than five percent of the. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331.

The amount of the nonresidents federal gross estate plus the amount of any includible gifts exceeds the basic exclusion amount. The exclusion amount in 2021 increased to 11700000. This means that when someone dies and.

Start Your Tax Return Today. Wednesday January 20 2021. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

Fire Inspections Safety Permits. The previous limit for 2020 was 1158 million. We expect that President Biden will reduce the unified credit exemption.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

Propane Fueled Cooking Equipment. Diversity Inclusion and Elimination of Bias. A key component of this exclusion is the basic exclusion amount BEA.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. Change to Experienced Attorney Biennial CLE Requirement to Include One Credit Hour in Diversity. The unified credit exemption is an exemption from the estate and gift tax.

So individuals can pass 117 million to their heirsand couples can transfer twice that amountwithout. The previous limit for 2020 was 1158 million.

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

A Guide To Estate Taxes Mass Gov

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

U S Estate Tax For Canadians Manulife Investment Management

A Taxing Matter For Family Businesses Mercer Capital

Exploring The Estate Tax Part 2 Journal Of Accountancy

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Warshaw Burstein Llp 2022 Trust And Estates Updates

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm