what is a closed tax lot report

By definition cost basis is the original value of a stock investment or any asset adjusted for stock splits certain types of dividends return of capital distributions and other adjustments. Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security.

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

What is a closed tax lot Report.

. User ID Password Log In. If I round to whole dollars as I do for the rest of my return this results in my listing a. A tax-lot relief method is used to determine which lots of a security are liquidated first in a given sales transaction.

Scroll down to the section Sale of Asset enter the sales price or if it was not sold enter -1 The above steps causes those assets highlighted to appear on form 4797 and boom bada bing. FIFO First In First Out LIFO Last In First Out HIFO Highest In First Out LOFO Lowest Cost First Out HCST Highest Cost Short Term HCLT Highest Cost Long Term LCLT Lowest Cost Long Term and LCST Lowest Cost Short. Tax Lot Accounting.

Go to your Accounts page. Short- or long-term status of the sale. But if the shares sold were the 6 shares then the profit is only 80 and we would.

Not sure if that matters but thought of mentioning it. Short- or long-term status of the sale. In the menu located next to the account select Tax Information.

Gain or loss amount. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make more than one. Input the Purchase Date Number of Shares and Total Purchase Cost and then select the.

Every time you sell shares a closed tax lot is created to track the date and price of your sale. If available gainloss information is provided for closed lots that require 1099-B reporting. What is a closed tax lot report Monday March 14 2022 Edit.

To edit your tax lot. 4 I had reached out to Payroll for clarification about reporting compensation from Lot 1 and Lot 2 on my paychecks and also on w-2 Box 1 but NOT reporting anything for Lot 3. In our example above we sold 20 shares of Company XYZ for 10 per share.

If those shares were the 5 shares then the profit is 100 and we would pay taxes on 100. With closed tax lots you can track the following information for each security you currently own. The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021.

Tax lot accounting is the record of tax lots. Choose the time period and either Realized or Unrealized gain and loss information then select View Gains. Enter the date the business closed if known otherwise enter 1231 of the tax year you are preparing.

The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. Short- or long-term status of the sale. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and you enter a trade to sell only part.

For example if you sold the investment that cost you 100599 in the example above for 1200 youll. A lot or parcel created by an intervening section or township line or right of way. In turn it helps identify the cost basis and holding period of the asset sold.

By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits or taxable capital gains generated in the transaction. A lot or parcel created by an unrecorded subdivision unless the lot or parcel was conveyed pursuant to subsection A3. Gain or loss amount.

Every time you sell shares a closed tax lot is created to track the date and price of your sale. Gainloss information is not provided for transactions that Fidelity is not required to report on Form 1099-B such as transfers to other accounts. This was NOT mentioned against Lot3.

The 1099-B I received from my brokerage includes several transactions labeled as UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS Theyre all for a physical metal ETF. Gain or loss amount. Your capital gain or loss is equal to the difference between the assets cost basis and the sales price of the closing transaction.

Every time you sell shares a closed tax lot is created to track the date and price of your sale. These methods are as follows. It mentioned that Tax lot closed is a specified lot.

Finally the tax lot includes the sale price of the securities in the lot. They all show quantity of 0 and the proceeds for each are less than 050c. The business is closed and you are ready to.

There are eight available tax lot relief methods from which clients can choose as their standing tax lot relief method. Tax lot accounting is important because it helps investors minimize their capital gains taxes. A lot or parcel created solely by a tax lot segregation because of an assessors roll change or for the convenience of the assessor.

A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A tax lot identification method is the way we determine. With closed tax lots you can track the following information for each security you currently own. Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot ID method we are required by the tax law to apply FIFO.

Under a noncovered tax lot select Edit Tax Lot.

How To Read Your Brokerage 1099 Tax Form Youtube

Credit Card Statement Template Excel Unique Small S Accounts Spreadsheet Plan Income Business Budget Template Spreadsheet Template Excel Spreadsheets Templates

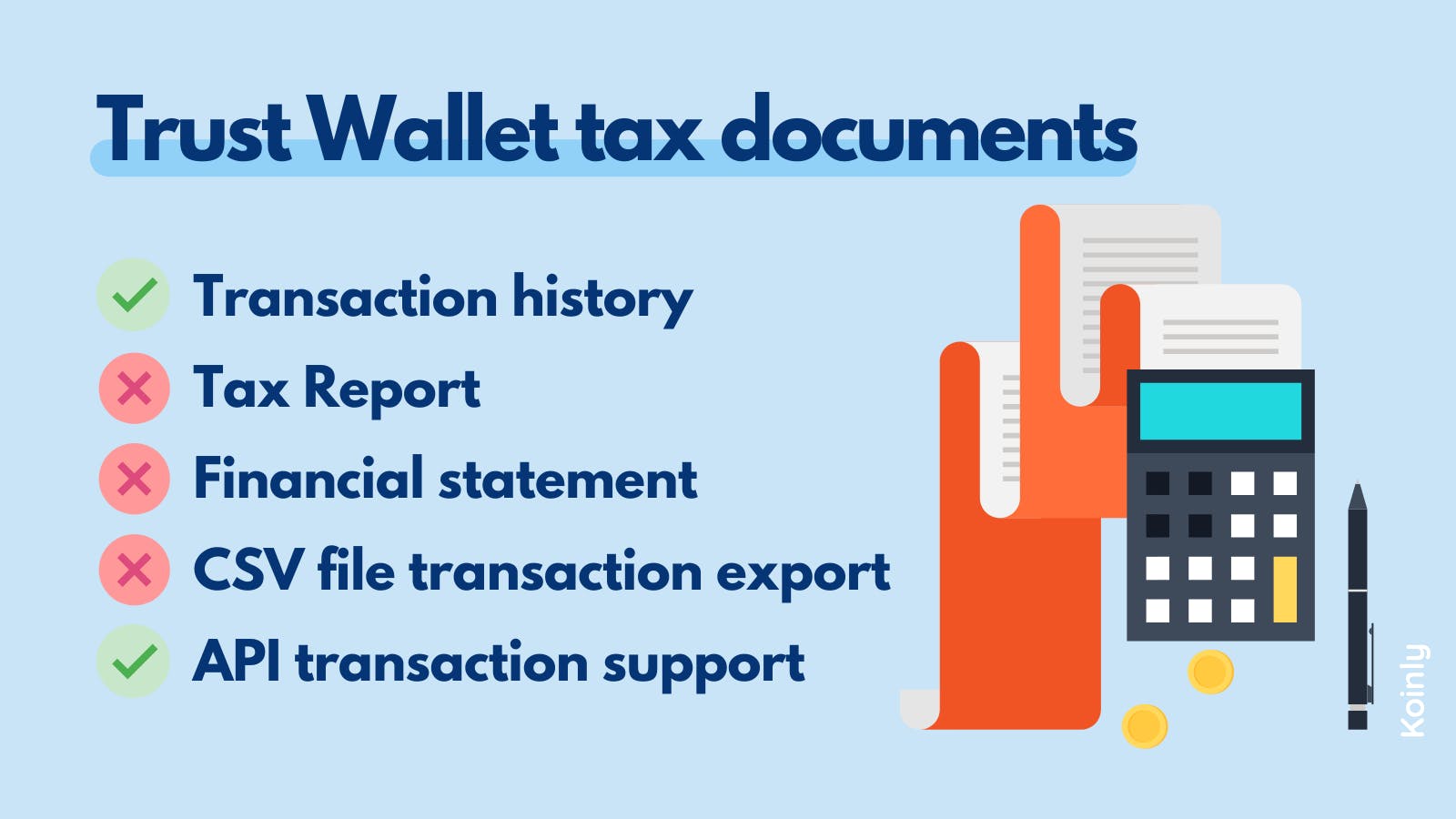

How To Do Your Trust Wallet Taxes Koinly

10 Things To Consider When Choosing An Accounting Firms In Dubai Uae

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Accounting Equation Chart Cheat Sheet

4 Steps To View The Shopify Finances Summary Page On Shopify

Irs Wash Sale Rule Guide For Active Traders

5 Investment Tax Mistakes To Avoid

How To Do Your Trust Wallet Taxes Koinly

Notes On Tax Planning Services Tax Preparation How To Plan Tax

Rental Security Deposit Refund Form

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Sample Payroll Tax Form 940 Payroll Taxes Tax Forms Payroll

Definition What Is A Tax Return Tax Return Tax Preparation Tax Preparation Services